ViacomCBS Reports Q4 and Full Year 2019 Results; Provides Strategic Update

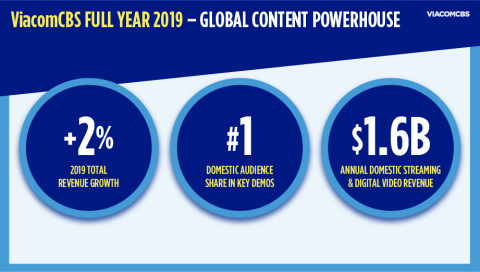

- Full Year Revenue Increased 2%, Driven by Growth in Advertising, Affiliate and Content Licensing; Operating Income, Net Earnings and Diluted EPS Impacted by Q4

- Transitional Q4 Included Merger-Related Expenses, As Well As Operating Items Expected to be Mitigated Through Benefits of the Combined Company

- Moving Quickly on Integration: Consolidated Teams in Place; Increasing Annualized Run-Rate Cost Synergy Target to

$750M from$500M - Go-Forward Strategy Will Unlock Incremental Value from Content, Revenue Lines and Streaming

- Expanded Portfolio of Platforms Increases Content ROI, Monetization Opportunities

- Domestic Streaming and Digital Video Business Already Generating Approximately

$1.6B in Annual Revenue, with Significant Momentum Going Forward

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200220005302/en/

Statement from

“In less than three months since completing our merger, we have made significant progress integrating and transforming

In 2020, our priorities are maximizing the power of our content, unlocking more value from our biggest revenue lines and accelerating our momentum in streaming. With this as a backdrop, we’ve set clear targets for the year and are providing increased transparency around our business to demonstrate ViacomCBS’ ability to create shareholder value today, as we continue evolving and growing our business for tomorrow.”

|

2019 RESULTS |

|||||||||||||||||||||||||||||||

|

Quarter Ended December 31 |

Full Year Ended December 31 |

||||||||||||||||||||||||||||||

|

2019 |

2018 |

|

B/(W) % |

2019 |

|

2018 |

|

B/(W)% |

|||||||||||||||||||||||

| GAAP | |||||||||||||||||||||||||||||||

| Revenues |

$ |

6,871 |

$ |

7,092 |

(3 |

) |

% |

$ |

27,812 |

$ |

27,250 |

2 |

% | ||||||||||||||||||

| Operating income (loss) |

(13 |

) |

1,259 |

NM |

4,273 |

5,204 |

(18 |

) |

|||||||||||||||||||||||

| Net earnings from continuing operations attributable to ViacomCBS |

(273 |

) |

884 |

NM |

3,270 |

3,423 |

(4 |

) |

|||||||||||||||||||||||

| Diluted EPS from continuing operations attributable to ViacomCBS |

(0.44 |

) |

1.43 |

NM |

5.30 |

5.51 |

(4 |

) |

|||||||||||||||||||||||

| Non-GAAP† | |||||||||||||||||||||||||||||||

| Adjusted OIBDA |

$ |

1,164 |

$ |

1,702 |

(32 |

) |

% |

$ |

5,531 |

$ |

6,289 |

(12 |

) |

% | |||||||||||||||||

| Adjusted net earnings from continuing operations attributable to ViacomCBS |

600 |

1,023 |

(41 |

) |

3,090 |

3,646 |

(15 |

) |

|||||||||||||||||||||||

| Adjusted diluted EPS from continuing operations attributable to ViacomCBS |

0.97 |

1.66 |

(42 |

) |

5.01 |

5.87 |

(15 |

) |

|||||||||||||||||||||||

| $ in millions, except per share amounts |

| † Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

| NM = Not Meaningful |

OVERVIEW OF Q4 & FULL YEAR REVENUE RESULTS

FULL YEAR

- Advertising revenue increased 2%, driven by 5% growth in domestic advertising sales, reflecting CBS’ broadcasts of Super Bowl LIII and the

NCAA Division I Men’s Basketball Tournament’s national semifinals and championship games, as well as higher revenues from Advanced Marketing Solutions (“AMS”) which includes Pluto TV, partially offset by lower political ad spend. - Affiliate revenue grew 3%, fueled by 20% growth in reverse compensation and retransmission, as well as strong subscription streaming revenue, which more than offset declines in pay TV subscribers.

- Content licensing revenue rose 5%, reflecting higher revenues from licensing library and original production to third parties.

- Domestic streaming and digital video business – which includes subscription revenue and digital video advertising – generated approximately

$1.6B in revenue.

Q4

- Affiliate revenue increased 1%, as strong growth in reverse compensation, retransmission and subscription streaming revenue more than offset declines in the pay TV landscape.

- Domestic advertising revenue was affected by significant declines in political advertising compared with the prior-year quarter.

- Domestic Cable Networks’ advertising revenue grew 9%, benefiting from AMS.

- Content licensing revenue declined 11% due to the timing and mix of deliveries.

|

REVENUE BY TYPE |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Quarter Ended December 31 |

Full Year Ended December 31 |

||||||||||||||||||||||||||||||||||||||||||||||

|

2019 |

2018 |

B/(W) % |

2019 |

|

|

2018 |

B/(W)% |

||||||||||||||||||||||||||||||||||||||||

| Advertising |

$ |

3,030 |

$ |

3,093 |

$ |

(63 |

) |

(2 |

) |

% |

$ |

11,074 |

$ |

10,841 |

$ |

233 |

2 |

% | |||||||||||||||||||||||||||||

| Domestic |

2,635 |

2,655 |

(20 |

) |

(1 |

) |

9,716 |

9,270 |

446 |

5 |

|||||||||||||||||||||||||||||||||||||

| International |

395 |

438 |

(43 |

) |

(10 |

) |

1,358 |

1,571 |

(213 |

) |

(14 |

) |

|||||||||||||||||||||||||||||||||||

| Affiliate |

2,133 |

2,112 |

21 |

1 |

8,602 |

8,376 |

226 |

3 |

|||||||||||||||||||||||||||||||||||||||

| Domestic |

1,975 |

1,941 |

34 |

2 |

7,937 |

7,667 |

270 |

4 |

|||||||||||||||||||||||||||||||||||||||

| International |

158 |

171 |

(13 |

) |

(8 |

) |

665 |

709 |

(44 |

) |

(6 |

) |

|||||||||||||||||||||||||||||||||||

| Content Licensing |

1,281 |

1,434 |

(153 |

) |

(11 |

) |

6,483 |

6,163 |

320 |

5 |

|||||||||||||||||||||||||||||||||||||

| Publishing |

215 |

218 |

(3 |

) |

(1 |

) |

814 |

825 |

(11 |

) |

(1 |

) |

|||||||||||||||||||||||||||||||||||

| Theatrical |

129 |

149 |

(20 |

) |

(13 |

) |

547 |

744 |

(197 |

) |

(26 |

) |

|||||||||||||||||||||||||||||||||||

| Other |

83 |

86 |

(3 |

) |

(3 |

) |

292 |

301 |

(9 |

) |

(3 |

) |

|||||||||||||||||||||||||||||||||||

| Total Revenues |

$ |

6,871 |

$ |

7,092 |

$ |

(221 |

) |

(3 |

) |

% |

$ |

27,812 |

$ |

27,250 |

$ |

562 |

2 |

% | |||||||||||||||||||||||||||||

| $ in millions | |||||||||||||||||||||||||||||||||||||||||||||||

STRATEGIC UPDATE

The company has a powerful content engine – including global production capabilities, and a vast library of premium TV and film titles – that spans all genres, formats, demographics and geographies. And,

1. Maximize the Power of Content

- Put the full power of the company behind its biggest priorities, while applying more rigor to managing content mix, investment and returns.

- Focus on global, cross-company franchise management to get the most out of powerful IP.

- Use ViacomCBS’ leadership positions off- and on-screen – and the company’s huge global footprint – to promote priorities.

- Prioritize content investment in streaming and studio production – two growth areas – while also optimizing programming mix to improve content ROI.

2. Unlock Value from Biggest Revenue Lines

- Drive growth across distribution, ad sales, content licensing and third-party studio production, enabled by the strength of the unified company’s asset base and its position as one of the most important partners in the media ecosystem.

- Distribution: Combine must-have content across broadcast and cable with proven partnership model to drive growth and share.

- Advertising: Benefit from leadership positions in linear and digital, and apply advanced advertising capabilities across expanded audience reach.

- Content Licensing: Package TV and film to create new content licensing opportunities and better meet client needs; use low-risk, profitable studio production business to grow content and IP library for the long-term in an economically efficient way.

3. Accelerate Momentum in Streaming

- Take a differentiated approach that builds on ViacomCBS’ unique foundation in streaming, plays to its strengths and fulfills unmet audience and partner needs.

- Complement the company’s leading free Pluto TV and premium pay Showtime OTT offerings by adding a broad pay offering, built on the foundation of CBS All Access.

- Offerings in free, broad pay and premium pay provides opportunity to serve largest potential consumer market while providing benefits in subscriber acquisition, churn and lifetime value.

- New broad pay “House of Brands” product will expand CBS All Access by adding the company’s scaled assets in film and TV, including world-renowned brands, and reaffirm and expand the value of entertainment, news and sports – through on-demand and live experiences – for audiences around the world.

- Go-to-market strategy includes partnerships with both traditional and new distributors, domestically and internationally.

TV ENTERTAINMENT

FINANCIAL RESULTS

- Full year revenue increased 8%, with growth across each of the segment’s main revenue lines.

- Full year Adjusted OIBDA decreased 1%, as a result of increased content investment and higher costs associated with the growth and expansion of streaming services, partially offset by higher revenues.

- Fourth quarter revenue declined 1%, as higher affiliate revenue was more than offset by lower political advertising sales and content licensing, compared to the prior year quarter.

- Fourth quarter Adjusted OIBDA declined, reflecting lower political advertising, content licensing and higher expenses.

OPERATIONAL HIGHLIGHTS

Viewing Performance and Programming:

CBS will conclude the broadcast season as America’s most-watched network for the 12th consecutive year, and season-to-date has the most top 30 regularly scheduled broadcast programs.CBS remained #1 in daytime and late night, and, among broadcast networks for viewers 2+, had 5 of the top 10 non-sports programs, and 5 of the top 6 freshman series.- On

CBS , theNFL finished the 2019-20 season as the most-watched season in three years.

Affiliate and Subscription Growth:

- In January,

ViacomCBS announced a renewed carriage agreement withComcast , including retransmission of 23CBS -owned TV stations in 15 major markets across the US. As part of the agreement, CBS All Access will be available on Xfinity X1 and Flex platforms. - In January, the premiere of Star Trek: Picard on CBS All Access broke internal records for total streams and subscriber signups.

Studio Production:

- CBS Television Studios continued to grow, with 79 shows ordered to or in production – a 23% increase from the previous year.

| Quarter Ended December 31 | Full Year Ended December 31 | ||||||||||||||||||||||||||||||||||||||||||||

|

2019 |

2018 |

B/(W) % |

2019 |

2018 |

B/(W)% |

||||||||||||||||||||||||||||||||||||||||

| Revenues |

$ |

3,126 |

$ |

3,149 |

$ |

(23 |

) |

(1 |

) |

% |

$ |

11,924 |

$ |

11,061 |

$ |

863 |

8 |

% | |||||||||||||||||||||||||||

| Advertising |

1,669 |

1,763 |

(94 |

) |

(5 |

) |

6,008 |

5,751 |

257 |

4 |

|||||||||||||||||||||||||||||||||||

| Affiliate |

682 |

538 |

144 |

27 |

2,550 |

2,082 |

468 |

22 |

|||||||||||||||||||||||||||||||||||||

| Content Licensing |

715 |

786 |

(71 |

) |

(9 |

) |

3,157 |

3,006 |

151 |

5 |

|||||||||||||||||||||||||||||||||||

| Other |

60 |

62 |

(2 |

) |

(3 |

) |

209 |

222 |

(13 |

) |

(6 |

) |

|||||||||||||||||||||||||||||||||

| Expenses |

2,501 |

2,433 |

(68 |

) |

(3 |

) |

9,481 |

8,595 |

(886 |

) |

(10 |

) |

|||||||||||||||||||||||||||||||||

| Adjusted OIBDA |

$ |

625 |

$ |

716 |

$ |

(91 |

) |

(13 |

) |

% |

$ |

2,443 |

$ |

2,466 |

$ |

(23 |

) |

(1 |

) |

% | |||||||||||||||||||||||||

| $ in millions | |||||||||||||||||||||||||||||||||||||||||||||

CABLE NETWORKS

FINANCIAL RESULTS

- Full year revenue declined 2%, as higher streaming and studio production revenue was more than offset by a decrease in linear subscribers and an approximate 200 bps unfavorable F/X impact.

- Full year Adjusted OIBDA decreased 19%, driven by lower revenues and increased costs, including higher investment in content and advertising and promotional expenses.

- Fourth quarter revenue declined 2% as linear subscriber declines more than offset growth from OTT services.

- Fourth quarter Adjusted OIBDA reflects increased investment in programming and OTT.

OPERATIONAL HIGHLIGHTS

Viewing Performance and Programming:

- Cable Networks’ total portfolio grew share for the full year, and owned more top 30 cable series in the quarter than any other cable family among key demos.

Showtime was the #1 premium network on Sunday nights in the quarter.Comedy Central had its 11th straight quarter of YOY share growth – its best streak ever. In January, the launch of Awkwafina is Nora From Queens was the network’s best series premiere in 3 years.- Paramount Network marked its 5th consecutive quarter of YOY share growth and finished the year with its largest YOY share gain in 14 years.

- Internationally, Telefe remained #1 in ratings, while Channel 5, Network 10,

MTV and Paramount Network grew YOY share in the quarter.

Studio Production:

- Awesomeness’ production of To All the Boys: P.S. I Still Love You premiered on

Netflix in February. - New productions for Quibi include MTV’s Punk’d and Singled Out, Comedy Central’s Reno 911 and Awesomeness’ One Night Forever.

|

Quarter Ended December 31 |

Full Year Ended December 31 |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2019 |

|

2018 |

|

|

|

B/(W) % |

|

|

|

2019 |

|

2018 |

|

|

B/(W)% |

||||||||||||||||||||||||||||||||||||||

| Revenues |

$ |

3,088 |

$ |

3,166 |

$ |

(78 |

) |

(2 |

) |

% |

$ |

12,449 |

$ |

12,683 |

$ |

(234 |

) |

(2 |

) |

% | |||||||||||||||||||||||||||||||||

| Advertising |

1,387 |

1,342 |

45 |

3 |

5,129 |

5,130 |

(1 |

) |

- |

||||||||||||||||||||||||||||||||||||||||||||

| Affiliate |

1,451 |

1,574 |

(123 |

) |

(8 |

) |

6,052 |

6,294 |

(242 |

) |

(4 |

) |

|||||||||||||||||||||||||||||||||||||||||

| Content Licensing |

250 |

250 |

- |

- |

1,268 |

1,259 |

9 |

1 |

|||||||||||||||||||||||||||||||||||||||||||||

| Expenses |

2,296 |

1,994 |

(302 |

) |

(15 |

) |

8,934 |

8,342 |

(592 |

) |

(7 |

) |

|||||||||||||||||||||||||||||||||||||||||

| Adjusted OIBDA |

$ |

792 |

$ |

1,172 |

$ |

(380 |

) |

(32 |

) |

% |

$ |

3,515 |

$ |

4,341 |

$ |

(826 |

) |

(19 |

) |

% | |||||||||||||||||||||||||||||||||

| $ in millions | |||||||||||||||||||||||||||||||||||||||||||||||||||||

FILMED ENTERTAINMENT

FINANCIAL RESULTS

- Full year revenue grew 1%, principally driven by licensing, which was partially offset by lower theatrical revenues.

- Full year Adjusted OIBDA grew to

$80M , principally driven by profits from licensing of films. - Fourth quarter revenue was impacted by current year slate performance and the number and mix of film titles compared to the prior year.

- Fourth quarter Adjusted OIBDA was an outlier when compared to the prior 8 quarters of YOY Adjusted OIBDA improvement.

OPERATIONAL HIGHLIGHTS

- While the Q4 film slate performance was soft, highly anticipated releases in 2020’s expanded slate:

- Currently in theatres, Sonic the Hedgehog has grossed over

$116M in worldwide box office in its opening weekend, holding the record for the best debut of a film based on a video game. - The SpongeBob Movie: Sponge on the Run, A Quiet Place Part II, Top Gun: Maverick coming in Q2.

- Currently in theatres, Sonic the Hedgehog has grossed over

Paramount Television Studios:

- Paramount Television Studios also continued to expand, with 27 shows ordered to, in production or on air.

- New series premieres include:

- On USA Network: Briarpatch in February

- On

BET : Season 2 of Boomerang onMarch 11th - On Spectrum’s On Demand platform: Paradise Lost on

April 13th - On Apple TV+: Home Before Dark and Defending Jacob in April

Strategic Investment:

- In December,

ViacomCBS announced an agreement withbeIN Media Group to acquire a 49% stake inMIRAMAX .- As part of the deal,

Paramount entered into an exclusive, long-term distribution agreement for MIRAMAX’s award-winning 700+ film library and a first-look agreement to develop, produce, finance and distribute new film and television projects based on its IP.

- As part of the deal,

| Quarter Ended December 31 | Full Year Ended December 31 | |||||||||||||||||||||||||||||||||||||||||||

|

2019 |

2018 |

|

B/(W) % |

2019 |

|

2018 |

B/(W)% |

|||||||||||||||||||||||||||||||||||||

| Revenues |

$ |

532 |

$ |

621 |

$ |

(89 |

) |

(14 |

) |

% |

$ |

2,990 |

$ |

2,956 |

$ |

34 |

1 |

% | ||||||||||||||||||||||||||

| Theatrical |

129 |

149 |

(20 |

) |

(13 |

) |

547 |

744 |

(197 |

) |

(26 |

) |

||||||||||||||||||||||||||||||||

| Home Entertainment |

155 |

178 |

(23 |

) |

(13 |

) |

623 |

617 |

6 |

1 |

||||||||||||||||||||||||||||||||||

| Licensing |

219 |

267 |

(48 |

) |

(18 |

) |

1,709 |

1,493 |

216 |

14 |

||||||||||||||||||||||||||||||||||

| Other |

29 |

27 |

2 |

7 |

111 |

102 |

9 |

9 |

||||||||||||||||||||||||||||||||||||

| Expenses |

651 |

698 |

47 |

7 |

2,910 |

2,989 |

79 |

3 |

||||||||||||||||||||||||||||||||||||

| Adjusted OIBDA |

$ |

(119 |

) |

$ |

(77 |

) |

$ |

(42 |

) |

(55 |

) |

% |

$ |

80 |

$ |

(33 |

) |

$ |

113 |

NM |

% | |||||||||||||||||||||||

| $ in millions | ||||||||||||||||||||||||||||||||||||||||||||

PUBLISHING

FINANCIAL RESULTS

- Full year revenue declined 1%, primarily reflecting lower print book sales, partially offset by 7% growth in digital.

- Full year Adjusted OIBDA decreased 7%, reflecting the decline in revenue and higher costs from the mix of titles.

OPERATIONAL HIGHLIGHTS

- Bestselling titles for the quarter included Stephen King’s The Institute, Alex DeMille’s The Deserter, and the relaunch of Joy of Cooking.

- For the year, bestselling titles included the “relaunch” as an author of

Howard Stern with Howard Stern Comes Again, Stephen King’s The Institute and David McCullough’s The Pioneers. - The Audio division also saw significant growth for the year from the world-class productions of titles, including The Mueller Report.

| Quarter Ended December 31 | Full Year Ended December 31 | ||||||||||||||||||||||||||||||||||||||||||||||

|

2019 |

2018 |

B/(W) % |

2019 |

|

|

2018 |

|

B/(W)% |

|

||||||||||||||||||||||||||||||||||||||

| Revenues |

$ |

215 |

$ |

218 |

$ |

(3 |

) |

(1 |

) |

% |

$ |

814 |

$ |

825 |

$ |

(11 |

) |

(1 |

) |

% | |||||||||||||||||||||||||||

| Expenses |

181 |

170 |

(11 |

) |

(6 |

) |

671 |

672 |

1 |

- |

|||||||||||||||||||||||||||||||||||||

| Adjusted OIBDA |

$ |

34 |

$ |

48 |

$ |

(14 |

) |

(29 |

) |

% |

$ |

143 |

$ |

153 |

$ |

(10 |

) |

(7 |

) |

% | |||||||||||||||||||||||||||

| $ in millions | |||||||||||||||||||||||||||||||||||||||||||||||

ABOUT

For more information about

VIAC-IR

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This communication contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: technological developments, alternative content offerings and their effects in our markets and on consumer behavior; the impact on our advertising revenues of changes in consumers’ content viewership, deficiencies in audience measurement and advertising market conditions; the public acceptance of our brands, programming, films, published content and other entertainment content on the various platforms on which they are distributed; increased costs for programming, films and other rights; the loss of key talent; competition for content, audiences, advertising and distribution in consolidating industries; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of our content; the risks and costs associated with the integration of the

|

VIACOMCBS INC. AND SUBSIDIARIES |

|||||||||||||||||||||||

|

|

Quarter Ended |

|

Year Ended |

||||||||||||||||||||

|

|

December 31, |

|

December 31, |

||||||||||||||||||||

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||||||||||||||

|

Revenues |

$ |

6,871 |

|

|

$ |

7,092 |

|

|

$ |

27,812 |

|

|

$ |

27,250 |

|

||||||||

|

Costs and expenses: |

|

|

|

|

|

|

|

||||||||||||||||

|

Operating |

|

4,806 |

|

|

|

4,259 |

|

|

|

17,223 |

|

|

|

15,917 |

|

||||||||

|

Selling, general and administrative |

|

1,490 |

|

|

|

1,293 |

|

|

|

5,647 |

|

|

|

5,206 |

|

||||||||

|

Depreciation and amortization |

|

120 |

|

|

|

105 |

|

|

|

443 |

|

|

|

433 |

|

||||||||

|

Restructuring and other corporate matters |

|

468 |

|

|

|

176 |

|

|

|

775 |

|

|

|

490 |

|

||||||||

|

Total costs and expenses |

|

6,884 |

|

|

|

5,833 |

|

|

|

24,088 |

|

|

|

22,046 |

|

||||||||

|

Gain on sale of assets |

— |

|

|

— |

|

|

|

549 |

|

|

— |

|

|||||||||||

|

Operating income (loss) |

|

(13 |

) |

|

|

1,259 |

|

|

|

4,273 |

|

|

|

5,204 |

|

||||||||

|

Interest expense |

|

(239 |

) |

|

|

(252 |

) |

|

|

(962 |

) |

|

|

(1,030 |

) |

||||||||

|

Interest income |

|

13 |

|

|

|

20 |

|

|

|

66 |

|

|

|

79 |

|

||||||||

|

Gain (loss) on marketable securities |

|

35 |

|

|

|

(46 |

) |

|

|

113 |

|

|

|

(23 |

) |

||||||||

|

Gain on early extinguishment of debt |

— |

|

|

|

18 |

|

|

— |

|

|

|

18 |

|

||||||||||

|

Other items, net |

|

(65 |

) |

|

|

(25 |

) |

|

|

(145 |

) |

|

|

(124 |

) |

||||||||

|

Earnings (loss) from continuing operations before income taxes and equity in loss of investee companies |

|

(269 |

) |

|

|

974 |

|

|

|

3,345 |

|

|

|

4,124 |

|

||||||||

|

(Provision) benefit for income taxes |

— |

|

|

|

(75 |

) |

|

|

9 |

|

|

|

(617 |

) |

|||||||||

|

Equity in loss of investee companies, net of tax |

— |

|

|

|

(2 |

) |

|

|

(53 |

) |

|

|

(47 |

) |

|||||||||

|

Net earnings (loss) from continuing operations |

|

(269 |

) |

|

|

897 |

|

|

|

3,301 |

|

|

|

3,460 |

|

||||||||

|

Net earnings from discontinued operations, net of tax |

|

15 |

|

|

|

3 |

|

|

|

38 |

|

|

|

32 |

|

||||||||

|

Net earnings (loss) (ViacomCBS and noncontrolling interests) |

|

(254 |

) |

|

|

900 |

|

|

|

3,339 |

|

|

|

3,492 |

|

||||||||

|

Net earnings attributable to noncontrolling interests |

|

(4 |

) |

|

|

(13 |

) |

|

|

(31 |

) |

|

|

(37 |

) |

||||||||

|

Net earnings (loss) attributable to ViacomCBS |

$ |

(258 |

) |

|

$ |

887 |

|

|

$ |

3,308 |

|

|

$ |

3,455 |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Amounts attributable to ViacomCBS: |

|

|

|

|

|

|

|

||||||||||||||||

|

Net earnings (loss) from continuing operations |

$ |

(273 |

) |

|

$ |

884 |

|

|

$ |

3,270 |

|

|

$ |

3,423 |

|

||||||||

|

Net earnings from discontinued operations, net of tax |

|

15 |

|

|

|

3 |

|

|

|

38 |

|

|

|

32 |

|

||||||||

|

Net earnings (loss) attributable to ViacomCBS |

$ |

(258 |

) |

|

$ |

887 |

|

|

$ |

3,308 |

|

|

$ |

3,455 |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Basic net earnings (loss) per common share attributable to ViacomCBS: |

|

|

|

|

|

|

|

||||||||||||||||

|

Net earnings (loss) from continuing operations |

$ |

(.44 |

) |

|

$ |

1.44 |

|

|

$ |

5.32 |

|

|

$ |

5.55 |

|

||||||||

|

Net earnings from discontinued operations |

$ |

.02 |

|

|

$ |

— |

|

|

$ |

.06 |

|

|

$ |

.05 |

|

||||||||

|

Net earnings (loss) |

$ |

(.42 |

) |

|

$ |

1.44 |

|

|

$ |

5.38 |

|

|

$ |

5.60 |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Diluted net earnings (loss) per common share attributable to ViacomCBS: |

|

|

|

|

|

|

|

||||||||||||||||

|

Net earnings (loss) from continuing operations |

$ |

(.44 |

) |

|

$ |

1.43 |

|

|

$ |

5.30 |

|

|

$ |

5.51 |

|

||||||||

|

Net earnings from discontinued operations |

$ |

.02 |

|

|

$ |

— |

|

|

$ |

.06 |

|

|

$ |

.05 |

|

||||||||

|

Net earnings (loss) |

$ |

(.42 |

) |

|

$ |

1.44 |

|

|

$ |

5.36 |

|

|

$ |

5.56 |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

||||||||||||||||

|

Basic |

|

615 |

|

|

|

614 |

|

|

|

615 |

|

|

|

617 |

|

||||||||

|

Diluted |

|

615 |

|

|

|

618 |

|

|

|

617 |

|

|

|

621 |

|

||||||||

|

VIACOMCBS INC. AND SUBSIDIARIES |

|||||||||||

|

|

|

At December 31, |

|

||||||||

|

|

|

2019 |

|

2018 |

|

||||||

|

ASSETS |

|

|

|

|

|

||||||

|

Current Assets: |

|

|

|

|

|

||||||

|

Cash and cash equivalents |

|

$ |

632 |

|

|

$ |

856 |

|

|

||

|

Receivables, net |

|

|

7,206 |

|

|

|

7,199 |

|

|

||

|

Programming and other inventory |

|

|

2,876 |

|

|

|

2,785 |

|

|

||

|

Prepaid expenses |

|

|

401 |

|

|

|

372 |

|

|

||

|

Other current assets |

|

|

787 |

|

|

|

668 |

|

|

||

|

Total current assets |

|

|

11,902 |

|

|

|

11,880 |

|

|

||

|

Property and equipment, net |

|

|

2,085 |

|

|

|

2,079 |

|

|

||

|

Programming and other inventory |

|

|

8,652 |

|

|

|

7,298 |

|

|

||

|

Goodwill |

|

|

16,980 |

|

|

|

16,526 |

|

|

||

|

Intangible assets, net |

|

|

2,993 |

|

|

|

2,943 |

|

|

||

|

Operating lease assets |

|

|

1,939 |

|

|

— |

|

|

|||

|

Deferred income tax assets, net |

|

|

939 |

|

|

|

266 |

|

|

||

|

Other assets |

|

|

4,006 |

|

|

|

3,449 |

|

|

||

|

Assets held for sale |

|

|

23 |

|

|

|

56 |

|

|

||

|

Total Assets |

|

$ |

49,519 |

|

|

$ |

44,497 |

|

|

||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

||||||

|

Current Liabilities: |

|

|

|

|

|

||||||

|

Accounts payable |

|

$ |

667 |

|

|

$ |

502 |

|

|

||

|

Accrued expenses |

|

|

1,760 |

|

|

|

1,633 |

|

|

||

|

Participants’ share and royalties payable |

|

|

1,977 |

|

|

|

1,828 |

|

|

||

|

Accrued programming and production costs |

|

|

1,500 |

|

|

|

1,453 |

|

|

||

|

Deferred revenues |

|

|

739 |

|

|

|

643 |

|

|

||

|

Debt |

|

|

717 |

|

|

|

1,013 |

|

|

||

|

Other current liabilities |

|

|

1,688 |

|

|

|

1,249 |

|

|

||

|

Total current liabilities |

|

|

9,048 |

|

|

|

8,321 |

|

|

||

|

Long-term debt |

|

|

18,002 |

|

|

|

18,100 |

|

|

||

|

Participants’ share and royalties payable |

|

|

1,546 |

|

|

|

1,587 |

|

|

||

|

Pension and postretirement benefit obligations |

|

|

2,121 |

|

|

|

1,908 |

|

|

||

|

Deferred income tax liabilities, net |

|

|

500 |

|

|

|

656 |

|

|

||

|

Operating lease liabilities |

|

|

1,909 |

|

|

— |

|

|

|||

|

Program rights obligations |

|

|

356 |

|

|

|

459 |

|

|

||

|

Other liabilities |

|

|

2,494 |

|

|

|

2,724 |

|

|

||

|

Redeemable noncontrolling interest |

|

|

254 |

|

|

239 |

|

|

|||

|

|

|

|

|

|

|

||||||

|

Commitments and contingencies |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||

|

ViacomCBS stockholders’ equity: |

|

|

|

|

|

||||||

|

Class A Common Stock, par value $.001 per share; 375 shares authorized; |

|

— |

|

|

— |

|

|

||||

|

Class B Common Stock, par value $.001 per share; 5,000 shares authorized; |

|

|

1 |

|

|

|

1 |

|

|

||

|

Additional paid-in capital |

|

|

29,590 |

|

|

|

49,907 |

|

|

||

|

Treasury stock, at cost; 501 (2019) and 734 (2018) Class B Shares |

|

|

(22,908 |

) |

|

|

(43,420 |

) |

|

||

|

Retained earnings |

|

|

8,494 |

|

|

|

5,569 |

|

|

||

|

Accumulated other comprehensive loss |

|

|

(1,970 |

) |

|

|

(1,608 |

) |

|

||

|

Total ViacomCBS stockholders’ equity |

|

|

13,207 |

|

|

|

10,449 |

|

|

||

|

Noncontrolling interests |

|

|

82 |

|

|

|

54 |

|

|

||

|

Total Equity |

|

|

13,289 |

|

|

|

10,503 |

|

|

||

|

Total Liabilities and Equity |

|

$ |

49,519 |

|

|

$ |

44,497 |

|

|

||

|

VIACOMCBS INC. AND SUBSIDIARIES |

|||||||||||

|

|

|

Year Ended December 31, |

|

||||||||

|

|

|

2019 |

|

2018 |

|

||||||

|

Operating Activities: |

|

|

|

|

|

||||||

|

Net earnings (ViacomCBS and noncontrolling interests) |

|

$ |

3,339 |

|

|

$ |

3,492 |

|

|

||

|

Less: Net earnings from discontinued operations, net of tax |

|

|

38 |

|

|

|

32 |

|

|

||

|

Net earnings from continuing operations |

|

|

3,301 |

|

|

|

3,460 |

|

|

||

|

Adjustments to reconcile net earnings from continuing operations to net cash flow provided by operating activities from continuing operations: |

|

|

|

|

|

||||||

|

Depreciation and amortization |

|

|

443 |

|

|

|

433 |

|

|

||

|

Television programming and feature film cost amortization |

|

|

12,554 |

|

|

|

11,595 |

|

|

||

|

Deferred tax (benefit) provision |

|

|

(769 |

) |

|

|

58 |

|

|

||

|

Stock-based compensation |

|

|

291 |

|

|

|

191 |

|

|

||

|

Net (gain) loss on dispositions and impairment of assets |

|

|

(498 |

) |

|

|

38 |

|

|

||

|

(Gain) loss on marketable securities |

|

|

(113 |

) |

|

|

23 |

|

|

||

|

Equity in loss of investee companies, net of tax and distributions |

|

|

58 |

|

|

|

54 |

|

|

||

|

Change in assets and liabilities |

|

|

|

|

|

||||||

|

Increase in receivables |

|

|

(256 |

) |

|

|

(368 |

) |

|

||

|

Increase in inventory and related program and participation liabilities, net |

|

|

(14,215 |

) |

|

|

(12,185 |

) |

|

||

|

Increase (decrease) in accounts payable and other liabilities |

|

|

297 |

|

|

|

(158 |

) |

|

||

|

Increase (decrease) in pension and postretirement benefit obligations |

|

|

16 |

|

|

|

(65 |

) |

|

||

|

Increase in income taxes |

|

|

160 |

|

|

|

398 |

|

|

||

|

Other, net |

|

|

(39 |

) |

|

|

(11 |

) |

|

||

|

Net cash flow provided by operating activities from continuing operations |

|

|

1,230 |

|

|

|

3,463 |

|

|

||

|

Net cash flow provided by operating activities from discontinued operations |

|

— |

|

|

|

1 |

|

|

|||

|

Net cash flow provided by operating activities |

|

|

1,230 |

|

|

|

3,464 |

|

|

||

|

Investing Activities: |

|

|

|

|

|

||||||

|

Investments |

|

|

(171 |

) |

|

|

(161 |

) |

|

||

|

Capital expenditures |

|

|

(353 |

) |

|

|

(352 |

) |

|

||

|

Acquisitions, net of cash acquired |

|

|

(399 |

) |

|

|

(118 |

) |

|

||

|

Proceeds from dispositions |

|

|

756 |

|

|

|

39 |

|

|

||

|

Other investing activities |

|

|

14 |

|

|

|

4 |

|

|

||

|

Net cash flow used for investing activities from continuing operations |

|

|

(153 |

) |

|

|

(588 |

) |

|

||

|

Net cash flow used for investing activities from discontinued operations |

|

|

(2 |

) |

|

|

(23 |

) |

|

||

|

Net cash flow used for investing activities |

|

|

(155 |

) |

|

|

(611 |

) |

|

||

|

Financing Activities: |

|

|

|

|

|

||||||

|

Proceeds from (repayments of) short-term debt borrowings, net |

|

|

25 |

|

|

|

(5 |

) |

|

||

|

Proceeds from issuance of senior notes |

|

|

492 |

|

|

— |

|

|

|||

|

Repayment of notes and debentures |

|

|

(910 |

) |

|

|

(1,102 |

) |

|

||

|

Dividends |

|

|

(595 |

) |

|

|

(599 |

) |

|

||

|

Purchase of Company common stock |

|

|

(57 |

) |

|

|

(586 |

) |

|

||

|

Payment of payroll taxes in lieu of issuing shares for stock-based compensation |

|

|

(56 |

) |

|

|

(67 |

) |

|

||

|

Proceeds from exercise of stock options |

|

|

15 |

|

|

|

29 |

|

|

||

|

Other financing activities |

|

|

(130 |

) |

|

|

(201 |

) |

|

||

|

Net cash flow used for financing activities |

|

|

(1,216 |

) |

|

|

(2,531 |

) |

|

||

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(1 |

) |

|

|

(25 |

) |

|

||

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

(142 |

) |

|

|

297 |

|

|

||

|

Cash, cash equivalents and restricted cash at beginning of year |

|

|

976 |

|

|

|

679 |

|

|

||

|

Cash, cash equivalents and restricted cash at end of year |

|

$ |

834 |

|

|

$ |

976 |

|

|

||

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES

(Unaudited; in millions, except per share amounts)

Results for the quarters and years ended

Because the adjusted measures are measures of performance not calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, operating income (loss), earnings (loss) from continuing operations before income taxes, (provision) benefit for income taxes, net earnings (loss) from continuing operations attributable to

The following tables reconcile the adjusted measures to their most directly comparable financial measures in accordance with GAAP.

|

|

Quarter Ended December 31, |

|

Year Ended December 31, |

||||||||||||||||||||||||

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||||||||||||||

|

Operating Income (Loss) (GAAP) |

|

$ |

(13 |

) |

|

|

|

$ |

1,259 |

|

|

|

|

$ |

4,273 |

|

|

|

|

$ |

5,204 |

|

|

||||

|

Depreciation and amortization (a) |

|

|

120 |

|

|

|

|

|

105 |

|

|

|

|

|

443 |

|

|

|

|

|

433 |

|

|

||||

|

Restructuring and other corporate matters (b) |

|

|

468 |

|

|

|

|

|

176 |

|

|

|

|

|

775 |

|

|

|

|

|

490 |

|

|

||||

|

Programming charges (b) |

|

|

589 |

|

|

|

|

|

162 |

|

|

|

|

|

589 |

|

|

|

|

|

162 |

|

|

||||

|

Gain on sale of assets (b) |

|

— |

|

|

|

|

— |

|

|

|

|

|

(549 |

) |

|

|

|

— |

|

|

|||||||

|

Adjusted OIBDA (Non-GAAP) |

|

$ |

1,164 |

|

|

|

|

$ |

1,702 |

|

|

|

|

$ |

5,531 |

|

|

|

|

$ |

6,289 |

|

|

||||

|

(a) The quarter and year ended December 31, 2019 include an impairment charge of $20 million to reduce the carrying value of intangible assets. |

|

(b) See notes on the following tables for additional information on items affecting comparability. |

|

|

Quarter Ended December 31, 2019 |

|||||||||||||||||||||||||||

|

|

Earnings |

|

Provision for |

|

Net Earning |

|

Diluted EPS |

|||||||||||||||||||||

|

Reported (GAAP) |

|

$ |

(269 |

) |

|

|

|

$ |

— |

|

|

|

|

$ |

(273 |

) |

|

|

|

$ |

(.44 |

) |

|

|||||

|

Items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Restructuring and other corporate matters (c) |

|

|

468 |

|

|

|

|

|

(88 |

) |

|

|

|

|

380 |

|

|

|

|

|

.61 |

|

|

|||||

|

Impairment charge (d) |

|

|

20 |

|

|

|

|

|

(6 |

) |

|

|

|

|

14 |

|

|

|

|

|

.02 |

|

|

|||||

|

Programming charges (e) |

|

|

589 |

|

|

|

|

|

(142 |

) |

|

|

|

|

447 |

|

|

|

|

|

.73 |

|

|

|||||

|

Net loss from investments (f) |

|

|

4 |

|

|

|

|

|

(3 |

) |

|

|

|

|

1 |

|

|

|

|

— |

|

|

||||||

|

Discrete tax items |

|

— |

|

|

|

|

|

31 |

|

|

|

|

|

31 |

|

|

|

|

|

.05 |

|

|

||||||

|

Adjusted (Non-GAAP) |

|

$ |

812 |

|

|

|

|

$ |

(208 |

) |

|

|

|

$ |

600 |

|

|

|

|

$ |

.97 |

|

|

|||||

|

|

Year Ended December 31, 2019 |

|||||||||||||||||||||||||||

|

|

Earnings from |

|

Benefit |

|

Net Earnings |

|

Diluted EPS |

|||||||||||||||||||||

|

Reported (GAAP) |

|

$ |

3,345 |

|

|

|

|

$ |

9 |

|

|

|

|

$ |

3,270 |

|

|

|

|

$ |

5.30 |

|

|

|||||

|

Items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Restructuring and other corporate matters (c) |

|

|

775 |

|

|

|

|

|

(134 |

) |

|

|

|

|

641 |

|

|

|

|

|

1.04 |

|

|

|||||

|

Impairment charge (d) |

|

|

20 |

|

|

|

|

|

(6 |

) |

|

|

|

|

14 |

|

|

|

|

|

.02 |

|

|

|||||

|

Programming charges (e) |

|

|

589 |

|

|

|

|

|

(142 |

) |

|

|

|

|

447 |

|

|

|

|

|

.73 |

|

|

|||||

|

Gain on sale of assets (g) |

|

|

(549 |

) |

|

|

|

|

163 |

|

|

|

|

|

(386 |

) |

|

|

|

|

(.63 |

) |

|

|||||

|

Net gain from investments (f) |

|

|

(85 |

) |

|

|

|

|

16 |

|

|

|

|

|

(69 |

) |

|

|

|

|

(.11 |

) |

|

|||||

|

Discrete tax items (h) |

|

— |

|

|

|

|

|

(827 |

) |

|

|

|

|

(827 |

) |

|

|

|

|

(1.34 |

) |

|

||||||

|

Adjusted (Non-GAAP) |

|

$ |

4,095 |

|

|

|

|

$ |

(921 |

) |

|

|

|

$ |

3,090 |

|

|

|

|

$ |

5.01 |

|

|

|||||

|

(a) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented. |

|

(b) Reported EPS for the quarter ended December 31, 2019 excludes the dilutive impact to shares since we reported a net loss. Adjusted EPS is calculated based on diluted weighted average shares outstanding of 618 million. |

|

(c) The quarter and year ended December 31, 2019 include severance and exit costs relating to restructuring activities and costs incurred in connection with the merger of Viacom Inc. with and into CBS Corporation (the “Merger”). The year also includes costs relating to legal proceedings involving the Company and other corporate matters. |

|

(d) Reflects a charge to reduce the carrying value of our international broadcast licenses in Australia to their fair value. |

|

(e) Programming charges principally reflected accelerated amortization associated with changes in the expected monetization of certain programs, and decisions to cease airing, alter future airing patterns or not renew certain programs, in connection with management changes implemented as a result of the Merger. |

|

(f) Includes an impairment charge of $50 million for the quarter and year ended December 31, 2019 to write-down an investment to its fair value; a gain on marketable securities of $35 million for the quarter and $113 million for the year; and gains on the sale and acquisition of joint ventures of $11 million for the quarter and $22 million for the year. |

|

(g) Reflects a gain on the sale of the CBS Television City property and sound stage operation (“CBS Television City”). |

|

(h) Primarily reflects a deferred tax benefit of $768 million resulting from the transfer of intangible assets between our subsidiaries in connection with a reorganization of our international operations; tax benefits of $44 million realized in connection with the preparation of the 2018 federal tax return, based on further clarity provided by the United States government on tax positions relating to federal tax legislation enacted in December 2017 (the “Tax Reform Act”); and a tax benefit of $39 million triggered by the bankruptcy of an investee. |

|

|

Quarter Ended December 31, 2018 |

|||||||||||||||||||||||||||

|

|

Earnings from |

|

Provision for |

|

Net Earnings |

|

Diluted EPS |

|||||||||||||||||||||

|

Reported (GAAP) |

|

$ |

974 |

|

|

|

|

$ |

(75 |

) |

|

|

|

$ |

884 |

|

|

|

|

$ |

1.43 |

|

|

|||||

|

Items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Restructuring and other corporate matters (b) |

|

|

176 |

|

|

|

|

|

(41 |

) |

|

|

|

|

135 |

|

|

|

|

|

.22 |

|

|

|||||

|

Programming charges (c) |

|

|

162 |

|

|

|

|

|

(39 |

) |

|

|

|

|

123 |

|

|

|

|

|

.20 |

|

|

|||||

|

Gain on early extinguishment of debt |

|

|

(18 |

) |

|

|

|

|

4 |

|

|

|

|

|

(14 |

) |

|

|

|

|

(.02 |

) |

|

|||||

|

Loss on marketable securities |

|

|

46 |

|

|

|

|

|

(11 |

) |

|

|

|

|

35 |

|

|

|

|

|

.06 |

|

|

|||||

|

Discrete tax items (d) |

|

— |

|

|

|

|

|

(140 |

) |

|

|

|

|

(140 |

) |

|

|

|

|

(.23 |

) |

|

||||||

|

Adjusted (Non-GAAP) |

|

$ |

1,340 |

|

|

|

|

$ |

(302 |

) |

|

|

|

$ |

1,023 |

|

|

|

|

$ |

1.66 |

|

|

|||||

|

|

Year Ended December 31, 2018 |

|||||||||||||||||||||||||||

|

|

Earnings from |

|

Provision for |

|

Net Earnings |

|

Diluted EPS |

|||||||||||||||||||||

|

Reported (GAAP) |

|

$ |

4,124 |

|

|

|

|

$ |

(617 |

) |

|

|

|

$ |

3,423 |

|

|

|

|

$ |

5.51 |

|

|

|||||

|

Items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Restructuring and other corporate matters (b) |

|

|

490 |

|

|

|

|

|

(116 |

) |

|

|

|

|

374 |

|

|

|

|

|

.60 |

|

|

|||||

|

Programming charges (c) |

|

|

162 |

|

|

|

|

|

(39 |

) |

|

|

|

|

123 |

|

|

|

|

|

.20 |

|

|

|||||

|

Gain on early extinguishment of debt |

|

|

(18 |

) |

|

|

|

|

4 |

|

|

|

|

|

(14 |

) |

|

|

|

|

(.02 |

) |

|

|||||

|

Net loss from investments (e) |

|

|

53 |

|

|

|

|

|

(16 |

) |

|

|

|

|

37 |

|

|

|

|

|

.06 |

|

|

|||||

|

Discrete tax items (d) |

|

— |

|

|

|

|

|

(297 |

) |

|

|

|

|

(297 |

) |

|

|

|

|

(.48 |

) |

|

||||||

|

Adjusted (Non-GAAP) |

|

$ |

4,811 |

|

|

|

|

$ |

(1,081 |

) |

|

|

|

$ |

3,646 |

|

|

|

|

$ |

5.87 |

|

|

|||||

|

(a) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented. |

|

(b) Primarily reflects severance and exit costs relating to restructuring activities as well as professional fees related to other corporate matters. |

|

(c) Reflects programming charges resulting from changes to our programming strategy, including at CBS Films and our Cable Networks segment, in connection with management changes. |

|

(d) The quarter and year ended December 31, 2018 include the reversal of a valuation allowance of $140 million relating to capital loss carryforwards that were utilized in connection with the sale of CBS Television City in 2019. The year also includes a net discrete tax benefit of $80 million related to the Tax Reform Act and other tax law changes, as well as a net tax benefit of $71million relating to a tax accounting method change granted by the Internal Revenue Service. |

|

(e) Reflects a loss on marketable securities of $23 million; an impairment charge of $46 million to write-down an investment to its fair value; and a gain of $16 million on the sale of a 1% equity interest in Viacom18 to our joint venture partner. |

Free Cash Flow

Free cash flow is a non-GAAP financial measure. Free cash flow reflects our net cash flow provided by operating activities before operating cash flow from discontinued operations, and less capital expenditures. Our calculation of free cash flow includes capital expenditures because investment in capital expenditures is a use of cash that is directly related to our operations. Our net cash flow provided by operating activities is the most directly comparable GAAP financial measure.

Management believes free cash flow provides investors with an important perspective on the cash available to us to service debt, make strategic acquisitions and investments, maintain our capital assets, satisfy our tax obligations, and fund ongoing operations and working capital needs. As a result, free cash flow is a significant measure of our ability to generate long-term value. It is useful for investors to know whether this ability is being enhanced or degraded as a result of our operating performance. We believe the presentation of free cash flow is relevant and useful for investors because it allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management. Free cash flow is among several components of incentive compensation targets for certain management personnel. In addition, free cash flow is a primary measure used externally by our investors, analysts and industry peers for purposes of valuation and comparison of our operating performance to other companies in our industry.

As free cash flow is not a measure calculated in accordance with GAAP, free cash flow should not be considered in isolation of, or as a substitute for, either net cash flow provided by (used for) operating activities as a measure of liquidity or net earnings (loss) as a measure of operating performance. Free cash flow, as we calculate it, may not be comparable to similarly titled measures employed by other companies. In addition, free cash flow as a measure of liquidity has certain limitations, does not necessarily represent funds available for discretionary use and is not necessarily a measure of our ability to fund our cash needs.

The following table presents a reconciliation of our net cash flow provided by (used for) operating activities to free cash flow:

|

|

Quarter Ended |

|

Year Ended |

|||||||||||||||||

|

|

December 31, |

|

December 31, |

|||||||||||||||||

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|||||||||||||

|

Net cash flow provided by (used for) operating activities (GAAP) |

$ |

(459 |

) |

|

$ |

474 |

|

|

$ |

1,230 |

|

|

$ |

3,464 |

|

|||||

|

Capital expenditures |

|

(102 |

) |

|

|

(103 |

) |

|

|

(353 |

) |

|

|

(352 |

) |

|||||

|

Less: Operating cash flow from discontinued operations |

— |

|

|

— |

|

|

— |

|

|

|

1 |

|

||||||||

|

Free cash flow (Non-GAAP) |

$ |

(561 |

) |

|

$ |

371 |

|

|

$ |

877 |

|

|

$ |

3,111 |

|

|||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20200220005302/en/

Source:

Press:

Justin Dini

Senior Vice President, Corporate Communications

(212) 846-2724

justin.dini@viacbs.com

Justin Blaber

Senior Director, Corporate Communications

(212) 846-3139

justin.blaber@viacom.com

Pranita Sookai

Director, Corporate Communications

(212) 846-7553

pranita.sookai@viacom.com

Investors:

Anthony DiClemente

Executive Vice President, Investor Relations

(212) 846-5208

anthony.diclemente@viacbs.com

Jaime Morris

Vice President, Investor Relations

(212) 846-5237

jaime.morris@viacbs.com